Top 10 Best ️Investment Apps Make You so Rich | investment

How We Chose the Best Investment Apps

When it comes to investment apps, one of the most important things to look for is the fee schedule. We've included apps that charge a fixed fee or percentage fee, and we've also found a few that don't charge any fees. We also looked at whether you could buy fractional shares so you can start investing in big companies whose stock prices might exceed your budget. Another factor we considered was whether the app offered social features or community support so you could talk and learn from other like-minded investors.

Choose the investment app that's right for you

When comparing investment apps, it's important to think about how much you plan to invest and whether you want to put money in it and leave it or buy and sell it regularly. Some apps have minimum account balances that are required or charge fees that don't make sense for small investments.

Decide on the level of risk

Any investment is a risk - it's just a matter of the degree of risk. If you're just trying to have fun in the stock market or have a long way to go before trying to withdraw investments for retirement, you might be fine with taking a few riskier options in exchange for a possible higher. reward. But there are also options for those who want to take the safest route. It's a good idea to think about your investment strategy beforehand so you can choose an app that suits your needs.

1/ Acorns: Invest Spare Change

|

| Acorns: Invest Spare Change |

Get started in minutes and give your money a chance to grow in the context of life.

Investing is now for everyone.

- INVEST FOR YOUR FUTURE - Invest spare change with automatic Round-Ups and set it and forget it with recurring investments. Your money is automatically invested in one of our diversified, expertly constructed ETF portfolios.

- INVEST FOR RETIREMENT - Save for retirement with our easy IRA options, including SEP, Traditional, and Roth plans. In less than 2 minutes, we'll recommend the plan that's right for you.

- INVEST FOR YOUR KIDS - Get Acorns Early, our UTMA/UGMA investment account for kids. Several children included. Personalized rewards for families. Automatically invest in a diversified ETF portfolio, built by experts.

- BANK SMARTER - Get an Acorns checking account and heavy metal debit card that invests when you spend and automatically invests a portion of every paycheck. You can also get paid up to 2 days earlier when you set up your direct deposit in Acorns Checking.

- EARN REWARDS - Shop over 12,000 brands that invest in you, search MILLIONS of jobs in our Job Finder and earn exciting referral bonuses. The more you earn, the more you can save and invest!

- DEVELOP YOUR KNOWLEDGE - Personalized financial literacy content, powered by Acorns + CNBC, right in your app.

SAVE AND INVEST RESPONSIBLY WITH A PARTNER WITH A MISSION

- MISSION: With benevolence and courage, we look after the best financial interests of young people, starting with the rewarding and proud stage of micro-investment.

- INVESTMENT PHILOSOPHY: The proven power of compounding, diversification and persistence gives your money a chance to grow over the long term.

- BACKED BY THE BEST: Investors like Blackrock, CNBC, PayPal, Dwayne Johnson, Jennifer Lopez, Steve Harvey and Ashton Kutcher.

- SECURITY: Bank level security and data encryption.

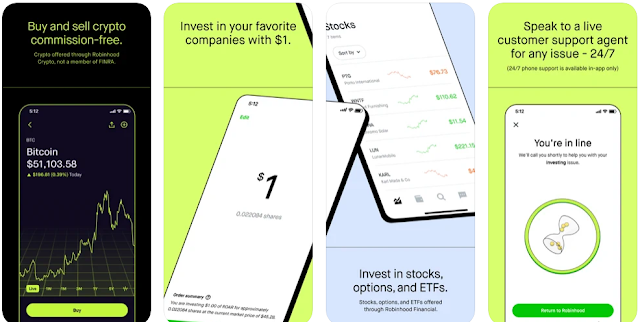

2/ Robinhood: Investing for All

|

| Robinhood: Investing for All |

Invest in stocks, options, and ETFs with Robinhood Financial. Buy and sell cryptos like Bitcoin, Ethereum, and Dogecoin with Robinhood Crypto. All without commission and without a minimum account.

Whether you're new to the markets or an experienced trader, we have the tools to help you invest. From commission-free trading to intuitive design, investing is now more accessible and affordable.

Here's what you get when you join Robinhood

- Finance Explained - helps you better understand the financial markets so you can invest in ETFs, stocks, and options.

- Trading Tools - Access real-time market data, view analyst notes, read relevant news articles, and be notified of important events.

- Security and support - protect your assets and offer robust security tools to help protect your account. When you need assistance, we offer a dedicated team of professionals as well as 24/7 live phone support via the app.

Plus, you have a variety of products to help you grow your money.

STOCKS, ETFs, OPTIONS AND CRYPTO

With Robinhood Financial you can invest in stocks, ETFs, and options. You can also buy and sell cryptocurrencies such as Bitcoin (BTC), Bitcoin Cash (BCH), Bitcoin SV (BSV), Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC), and Dogecoin (DOGE) with Robinhood Crypto.

FINANCE MANAGEMENT

Receive your paycheck, pay bills, send checks, and more. To top it off, earn a competitive interest rate on your uninvested money and get more flexibility with your brokerage account.

3/ Stash: Invest & Build Wealth

|

| Stash: Invest & Build Wealth |

Stash is a personal finance app that makes investing easy and affordable for millions of Americans. By combining banking and investing in one app, Stash helps you build wealth your way.

Score bonus stocks and more in new investments every week, with Stash Stock Party, the digital party where you can invest, on us.

Smart Wallet - Now with Cryptocurrency Exposure: Invest Effortlessly.

Automatically build wealth with Smart Portfolio, letting us invest for you. Plus, get crypto exposure now – the smart way. We'll help you build a diversified portfolio that meets your financial goals.

INVEST: Invest what you can afford.

With fractional shares, you can choose how much to invest. Choose from thousands of stocks and ETFs.

STOCK-BACK CARD: Invest as you spend.

When you use the Stock-Back Card, we offer you stock from well-known brands.

BANKING: Invest in your goals.

We can help you save money and protect you from hidden bank charges.

RETIREMENT: Invest in your future.

Stash can help you plan and save for a secure retirement.

FAMILY: Invest in your children.

Help those you love most with Children's Investment Accounts.

TIP: Invest in your knowledge.

Get personalized investment advice and financial education.

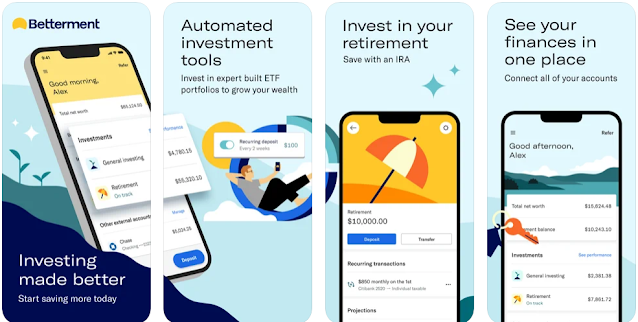

4/ Betterment: Investing & Saving

|

| Betterment: Investing & Saving |

Invest better with Betterment. Investing in apps costs a dime, right? So, you might be wondering why you should download this investment app. It's simple: Betterment is designed to make investing easier, with a personalized experience that meets your needs, whether you're an investor in training or a stock market guru. Invest your money in the things you want the most, in order to live better.

Investments made easy because you have a lot to do

- Register in 3 minutes

- Invest in expert portfolios of global companies

- Start investing with a $10 deposit

- No minimum balance

- Low annual fee of 0.25%

Save more money cause duh

- Automated trading tools

- Automation of tax savings

- Investments are safe and secure

- Connect external accounts to get an overview

- Financial advice that puts your interests first

Personalized financial planning, because we love you the way you are

- Investments designed for your personal savings goals

- Investing tools designed for all experience levels

- Customize your level of stock and bond risk

- Invest in our socially responsible options

- Financial Advisor - Upgrade for more personalized service from an expert

Get more with Betterment

- Manage money for daily expenses by Checking

- Rewards on thousands of brands with the Betterment Visa debit card

- Save money and earn interest on your money with Cash Reserve

- Retirement savings with an IRA (Roth, traditional)

- Planning for retirement with a 401(k) plan

5/ TD Ameritrade Mobile

|

| TD Ameritrade Mobile |

Moving? The market too. Stay in control with the TD Ameritrade Mobile app. Monitor the markets and your positions, deposit funds with a mobile check deposit, follow the latest news and research or browse educational content, all from your mobile device. Trade with confidence wherever you go, with the security and precision of your desktop in the palm of your hand.

All the features you need:

- Follow the market with price alerts, real-time quotes, helpful charts, Level II quotes and news

- Track and trade stocks, options (up to two-pronged strategies), options chains, and exchange-traded funds (ETFs), and even check your order status on the go

- Transfer funds to and from your account and use mobile check deposit to deposit funds whenever you want

- Use Face Unlock or fingerprint authentication to log in and authorize trades and transfers

- Take advantage of educational offerings and browse videos on investment strategies, stocks, options, and more anytime, anywhere

- Access third-party research such as video on demand from Thomson Reuters and CNBC, and stay up to date with the latest analyst reports, social signals and Twitter integration

- Use alerts to spot potential trading opportunities, receive notifications when certain price targets are reached, and stay informed when key news or events occur.

- Manage and monitor your account with real-time balances and positions, tax statements and documents, transaction history, and our secure message center at your fingertips

- Customize your experience by configuring your Locations and Watchlist screens as you wish

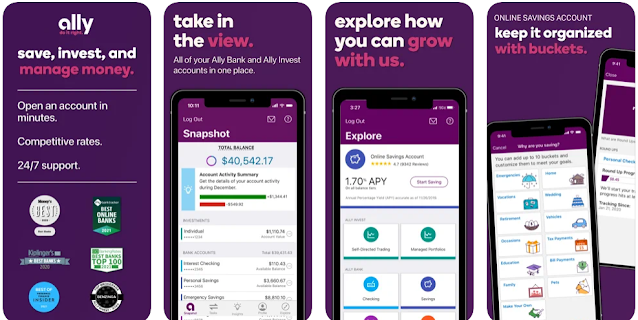

6/ Ally Mobile: Bank & Invest

|

| Ally Mobile: Bank & Invest |

Ally Mobile puts everyday banking and investing tasks at your fingertips. It's fast, secure, and free. You can also quickly access your account using biometrics.

Banking features

- Deposit checks with Ally eCheck Deposit

- Transfer money between your Ally Bank accounts and accounts from other banks

- Pay bills, view scheduled payments, and view payment history

- Check balances and search transaction history

- View and download tax statements and forms

- Use Zelle to pay anyone with a US bank account

- Find nearby ATMs

- Set up and manage your debit card preferences and control when, where and how your card is used with card controls

- Manage CD interest disbursement and maturity options

- Order checks

- View and send secure messages, or chat with us using Ally Messenger

- Update your contact information

Save faster with a smarter online savings account

- Use buckets to organize your money and visualize what you're saving for

- Set up boosters to optimize and maximize your savings

- Analyze your account performance using relevant charts and graphs

Investment characteristics

Managed portfolios

- Cash-enriched managed portfolios offer hands-off investing with no advisory fees

- Market-based options for a fee that keep more of your money invested

- Automate your investments with one of our four portfolio strategies

- Monitor your account performance anytime, anywhere

- Use Goal Tracker to see your account performance

Self-directed

- Trade commission-free on eligible US stocks and ETFs

- Filter and find exchange-traded funds that match your investment goals with the ETF filter

- Trade stocks and multi-leg options from your mobile device

- Use advanced charting tools for technical analysis

- Monitor your investments with continuous quotes

- Access today's market news and market movements

- Check balances and search transaction history

How we prioritize your safety

- We never store personal or account information on your phone

- All transactions are encrypted with the same secure technology as online banking

- The login process is the same as for online banking, with security codes as an added layer of protection when logging in from a computer or device that we do not recognize.

- Our online and mobile security guarantee protects you against fraudulent transactions

More details

- Ally Mobile is free - your mobile carrier's messaging and data rates may apply

- Compatible with Android 5.0 or higher

- Deposit products offered by Ally Bank, Member FDIC

- Securities offered by Ally Invest Securities LLC, member FINRA/SIPC

- Securities are NOT FDIC INSURED, NOT BANK GUARANTEED and MAY LOSE VALUE

- You cannot be approved for real-time quotes

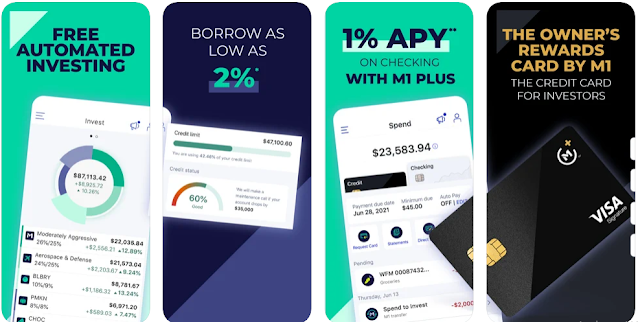

7/ M1: Commission-free Investing

|

| M1: Commission-free Investing |

M1 is the all-in-one super financial app. Build and manage your wealth from the convenience of an intuitive, high-tech mobile platform.

Hundreds of thousands of investors have trusted M1 Finance with over $5 billion in assets. See for yourself why M1 is an award-winning experience.

Plan long-term investments with just a few clicks and automate your finances with Smart Transfers: personalized rules that transfer your money the way you want.

INVEST

- Invest with an individual, joint, trust, or custody account. Or start with a traditional IRA, SEP, or Roth, or flip a 401(k).

- Buy stocks, ETFs, bonds, and mutual funds with an intuitive Pies interface; let our automated tools do the buying and selling for you.

- Predefined Expert Pies help you invest based on your values, risk tolerance, diversification strategy, retirement plans, or even strategies of successful investors.

- Fractional shares allow you to invest as little as a dollar, allowing you to invest with more power and flexibility.

- One-click rebalancing ensures your investments match your goals.

- With M1 Plus, get exclusive benefits, features, and rewards for just $125 per year, with your first year free.

TO BORROW

- Borrow on your investments with flexibility and ease with rates from 2% to 3.5%.

- Access your money with just a few clicks; use it for anything you want. A down payment, a margin investment or a dream vacation, anything.

TO PASS

- Save with free digital verification.

- Get 1% APY on your current balance (33x the national average) and 1% cashback when you are an M1 Plus member.

THE BY M1 OWNER REWARDS CARD

- Join M1 Plus to apply for a credit card like no other. Earn 2.5% to 10% cash back when you spend on select brands in your M1 wallet, and 1.5% cash back everywhere else.

- You can automatically reinvest your rewards money to build wealth, even if you spend it.

ACCOUNT PROTECTION

- Securities in M1 Invest accounts are insured for up to $500,000 by SIPC.

- M1 Spend checking accounts can be insured for up to $250,000 by the FDIC.

8/ Public- Stocks & Crypto

|

| Public- Stocks & Crypto |

- Invest with any amount of money. Start with a free slice of broth.

- Public helps you be a better investor.

- Invest in stocks, funds, and crypto. Be smarter with exclusive news and content.

BUILDING A MODERN PORTFOLIO

- Invest in stocks, funds, and crypto

- No minimum account or deposit to get started

- No commission fees when you invest in stocks and ETFs

- New IPOs, SPACs and crypto-assets added regularly

BE A BETTER INVESTOR

- Listen to daily audio broadcasts on the latest financial news and trends

- Submitting questions to CEOs and managers of public companies during public meetings

- Lock in long-term investments in a dedicated portfolio

- Understanding Risk and Volatility with Security Labels

- Automatically reinvest dividends

INVESTORS FIRST

- Public does not sell your trades to third party market makers

- Public takes no payment for order flow (PFOF)

JOIN THE COMMUNITY

- Follow friends, experienced investors, and notable entrepreneurs

- Share your views in an educational and inclusive community

- Earn free shares to help your friends start their investing journeys

AVAILABLE CRYPTOS

Explore a range of crypto assets, with new coins added regularly.

Bitcoin (BTC), Ether (ETH), Cardano (ADA), Shiba Inu (SHIB), Dogecoin (DOGE), Avalanche (AVAX), Solana (SOL), Uniswap (UNI), Chainlink (LINK), Polygon (MATIC) , Algorand (ALGO), Sushiswap (SUSHI), and more.

PROFESSIONAL AND SECURE

- Live customer support via in-app chat or email. We are always here to help or listen to you.

- Your safety is our #1 priority. We use advanced cybersecurity and encryption to protect your personal information.

- Open to the public Investing, Inc. is a member of the Securities Investor Protection Corporation (SIPC). Securities in your account are protected for up to $500,000.

- Open to the Public Investing, Inc. is a FINRA-regulated brokerage firm.

9/ SoFi - All-in-One Finance App

|

| SoFi - All-in-One Finance App |

SoFi is a one-stop shop for your finances, designed to help you Get Your Money Right. Save, spend, earn, borrow and invest, all in one app.

Download the SoFi app to get started and win up to $1,000 in free shares!

ONE CONVENIENT APP DOES IT ALL

Manage your money, invest and trade, check your rates and apply for loans. Do everything in one place.

EARN CASH REWARDS

When you save and spend with SoFi Money, you can earn high interest on all your money, up to 0.25% APY.

NO INVESTMENT ACCOUNT MINIMUM

SoFi Invest lets you trade cryptocurrency, and invest in stocks, ETFs, pension funds, and more, with no commissions or account minimums.

BORROW FOR SCHOOL, HOME IMPROVEMENT AND MORE

Just apply and start saving with a SoFi loan. No hidden fees and no catch. Just serious savings.

GET YOUR MONEY RIGHT WITH ZERO ACCOUNT FEES

Pay no account fees with SoFi Money, which includes no annual fees, overdrafts,s or other account fees.

SMART MONEY MOVEMENTS WIN YOU POINTS

Rewards points are redeemable for cash, fractional shares, SoFi loan repayments, and more.

FREE SPENDING AND BUDGETING TOOLS

Get free monitoring of your credit score, expense breakdowns, financial information and more.

ACCESS MEMBER BENEFITS

Members get unlimited access to one-on-one financial and career planning at no additional cost.

10/ Wealthfront: Save and Invest

|

| Wealthfront: Save and Invest |

AUTOMATE YOUR INVESTMENTS

Answer a few questions and we'll recommend a personalized diversified and automated portfolio for you. We take care of the transactions, reinvest your dividends and work to automatically reduce your taxes.

PERSONALIZE YOUR PORTFOLIO

You can modify your investments or allocations easily at any time. Explore hundreds of funds in categories like social responsibility, clean energy, healthcare, tech, cannabis, and even crypto.

TURN MONEY INTO WEALTH

Our banking features make it easy to spend, save and organize your money. And with direct deposit, we can split your paycheck and automatically transfer money for you. Meet your everyday cash needs with mobile checks, bill payment,s and thousands of free ATMs nationwide. In addition to free unlimited transfers, we never charge overdraft fees or account fees of any kind.

BORROW AT A LOW RATE

Get cash fast with a wallet line of credit without the hassle of a credit application or check. Borrow what you need without selling investments or disrupting your long-term goals.

YOUR WEALTH IN ONE PLACE

Get an overview of your finances and make sure you're on track now and in retirement. Say goodbye to multiple applications and take the guesswork out of building wealth.

Comments

Post a Comment