Top 10 Best Insurance Companies near me | Insurance

There are several ways to rank the size of insurance companies. Companies can be measured by their market capitalization (the value of the company on a stock exchange) or by using sales figures, such as net premiums written in a year or the number of policies sold. Here we look at the 10 largest insurance companies based on market capitalization, market share, and revenue.

KEY POINTS

- Insurance companies are important players in the global financial economy, although they are not as flashy as investment banks or hedge funds.

- Insurance companies vary in size and specialize in different lines of insurance, from health to life to property and casualty.

- Market capitalization, or market cap, is the value of a company's outstanding shares.

- Some insurance companies are jointly owned, meaning that the policyholders are the owners.

- When ranking insurance companies, it is important to classify them according to their product line.

Companies with large market capitalizations are generally established conservative investments. They are likely to experience steady growth and have the least amount of risk. Mid-cap companies are also established but have high growth potential. Finally, small-cap companies are often new businesses with high growth potential. Investing in these companies presents the greatest risk because they are more vulnerable to economic downturns than the more established large and mid-cap companies.

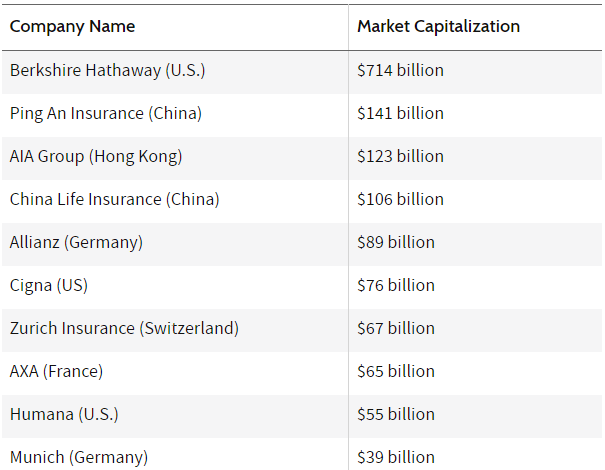

Investors can buy shares of publicly-traded companies in the insurance industry. The largest non-healthcare insurance companies by market capitalization on global exchanges are:

|

| Publicly Traded Non-health Insurance Companies |

Berkshire Hathaway (U.S.)

.PNG) |

| Berkshire Hathaway (U.S.) |

Berkshire Hathaway Inc is an American multinational conglomerate holding company headquartered in Omaha, Nebraska, USA. The company wholly owns GEICO, Duracell, Dairy Queen, BNSF, Lubrizol, Fruit of the Loom, Helzberg Diamonds, Long & Foster, FlightSafety International, Shaw Industries, Pampered Chef, Forest River, and NetJets, and also owns 38. 6% of Pilot Flying J; and significant minority stakes in public companies Kraft Heinz Company (26.7%), American Express (18.8%), The Coca-Cola Company (9.32%), Bank of America (11.9%), and Apple (6.3%).

Beginning in 2016, the company acquired significant stakes in the major U.S. airlines, United Airlines, Delta Air Lines, Southwest Airlines, and American Airlines, but sold all of its airline holdings in early 2020 following the COVID-19 pandemic. Berkshire Hathaway has averaged 19.0% annual growth in book value for its shareholders since 1965 (compared to 9.7% for the S&P 500, including dividends, for the same period) while using large amounts of capital and minimal debt.

The company is known for its control and leadership by Warren Buffett, who serves as chairman and CEO, and Charlie Munger, the company's vice-chairman. Early in his career at Berkshire, Buffett focused on long-term investments in publicly traded companies, but more recently he has more frequently purchased entire companies. Berkshire now owns a diverse range of businesses, including candy stores, retail businesses, railroads, home furnishings, encyclopedias, vacuum cleaner manufacturers, jewelry sales, uniform manufacturing and distribution, and several regional electric and gas utilities.

According to the Forbes Global 2000 list and formula, Berkshire Hathaway is the eighth largest public company in the world, the tenth-largest conglomerate by revenue, and the largest financial services company by revenue in the world.

As of August 2020, Berkshire's Class B stock is the seventh-largest component of the S&P 500 Index (which is based on free-floating market capitalization) and the company is famous for having the most expensive stock price in history, with Class A shares costing about $450,000 each. This is because its Class A shares have never been split and Buffett stated in a letter to shareholders in 1984 that he had no intention of splitting the stock.

On March 16, 2022, Berkshire Hathaway's Class A shares closed above the record high of $500,000 per share, bringing the company's market capitalization to over $730 billion.

Ping An Insurance (China)

.PNG) |

| Ping An Insurance (China) |

Ping An Insurance, also known as Ping An of China, full name Ping An Insurance (Group) Company of China, Ltd. is a Chinese conglomerate with subsidiaries primarily engaged in insurance, banking, asset management, financial services, healthcare, automotive services, and smart cities. The company was founded in 1988 and is headquartered in Shenzhen. "Ping An" literally means "safe and sound."

Ping An ranks 7th on the Forbes Global 2000 list and 21st on the Fortune Global 500 list.

The company is considered China's largest insurer, with US$110 billion in net written premiums in 2019. Its market capitalization is US$217 billion as of March 2021, making it the largest insurer in the Asia-Pacific region.

Ping An Insurance is one of the top 50 companies on the Shanghai Stock Exchange. It is also included in the Hang Seng Index, an index of the top 50 companies on the Hong Kong Stock Exchange. Ping An Insurance has also been included in the China CSI 300 Index, FTSE China A50 Index, and Hang Seng China 50 Index.

Ping An Insurance has been selected for the Dow Jones Sustainability Emerging Markets Index 2019 (DJSI). It is the first insurance company from mainland China to be selected in this index. Ping An is a signatory to the UN-backed Principles for Responsible Investment (PRI) and was the first asset owner in mainland China to join.

Ping An Insurance consistently ranks as the world's leading insurance brand and, as of 2020, was the most valuable global financial brand in the world.

AIA Group (Hong Kong)

.PNG) |

| AIA Group (Hong Kong) |

AIA Group Limited is a multinational insurance and finance company founded by Americans in Hong Kong. It is the largest publicly listed life insurance and securities group in the Asia-Pacific region. It provides insurance and finance services, underwrites personal and commercial life insurance, accident and health insurance, and offers retirement planning and wealth management services, variable contracts, investments, and securities.

AIA is headquartered in Central, Hong Kong, and operates in 18 markets in the Asia Pacific, with wholly-owned branches and subsidiaries in Hong Kong, mainland China, Taiwan, Macau, South Korea, Singapore, Thailand, Malaysia, the Philippines, Indonesia, Vietnam, Brunei, Cambodia, Myanmar, Australia, New Zealand, Sri Lanka, and a 49 percent joint venture in India. Since 2013, AIA has had an exclusive bancassurance agreement with Citibank that encompasses 11 AIA markets in the Asia Pacific.

In August 2013, AIA became the official shirt partner of English Premier League soccer club Tottenham Hotspur. AIA's contract with Tottenham was renewed in May 2017 to run through the 2021/22 Premier League season and again in July 2019 to extend through the end of the 2026/27 season.

China Life Insurance (China)

China Life Insurance Company Limited is a Beijing-based company under Chinese law that offers life insurance and annuity products. China Life is ranked No. 94 on the 2015 Fortune 500 list of global companies. Seventy percent state-owned, China Life is China's largest life insurer by total assets but has experienced economic difficulties in recent years. China's insurance market attracted dozens of new competitors after it was liberalized by the Chinese government, and China Life's market share has fallen by nearly half since 2007, from 50% to about 26%, according to Morningstar. The company is completing a major restructuring, and the government assigned a new CEO in 2014. A further surge in sales earlier this year (fueled by an army of newly hired agents) led to a sharp rise in net income in the first quarter of 2015. China Life is also listed in the Fortune China: 2015 Top 500 Chinese Enterprises ranking, in 13th place.

China Life has over 600,000 agents nationwide, making its cost of acquiring new customers relatively low. China Life has a significant share of the group life and health insurance business in China, and its ties to the government allow it to grow this business with state-owned enterprises.

In 2015, the Chinese government allowed Chinese insurance companies to invest in foreign real estate; China Life subsequently made its first such investment, in a waterfront project in Boston.

Allianz (Germany)

.PNG) |

| Allianz (Germany) |

Allianz SE is a German multinational financial services company headquartered in Munich, Germany. Its core businesses are insurance and asset management.

As of 2014, it is the world's largest insurance company, the largest financial services group, and the largest company according to a Forbes magazine composite measure, as well as the largest financial services company when measured by 2013 revenue. The company is a constituent of the Euro Stoxx 50 stock index.

Its asset management division, which consists of PIMCO, Allianz Global Investors, and Allianz Real Estate, has €2,432 billion in assets under management (AuM), including €1,775 billion in third-party assets (Q1 2021).

Allianz sold Dresdner Bank to Commerzbank in November 2008. As a result of this transaction, Allianz obtained a majority stake of 14% in the new Commerzbank.

Cigna (US)

.PNG) |

| Cigna (US) |

Cigna is a U.S. multinational health care management and insurance company headquartered in Bloomfield, Connecticut. Its insurance subsidiaries are major providers of medical, dental, disability, life and accident insurance, and related products and services, the majority of which are offered through employers and other groups (e.g., governmental and non-governmental organizations, unions, and associations). Cigna is incorporated in Connecticut.

Cigna provides Medicare and Medicaid products and health, life, and accident insurance coverage primarily to individuals in the United States and certain international markets. In addition to its current operations described above, Cigna also has certain run-off operations, including a run-off reinsurance segment. In the Phoenix metropolitan area, Cigna operates a full-service health maintenance organization with satellite clinics throughout the region, known as Cigna Medical Group. Cigna Global Health Benefits also operates within Cigna.

The company ranked 13th on the 2021 Fortune 500 list, which identifies the largest U.S. companies based on total revenue.

On March 7, 2018, it was announced that Cigna would acquire Express Scripts in a $67 billion transaction, and on August 24, 2018, Cigna and Express Scripts shareholders approved the deal.

Zurich Insurance (Switzerland)

.PNG) |

| Zurich Insurance (Switzerland) |

Zurich Insurance Group Ltd is a Swiss insurance company, headquartered in Zurich, and the country's largest insurer. In 2021, the group is the 112th largest public company in the world according to Forbes' Global 2000s list, and in 2011, it ranked 94th in Interbrand's top 100 brands.

Zurich is a global insurance company that is organized into three main business segments - General Insurance, Global Life, and Farmers. Zurich employs 55,000 people and has customers in 215 countries and territories. The company is listed on the SIX Swiss Exchange. In 2012, it had equity of $34.494 billion.

AXA (France)

.PNG) |

| AXA (France) |

Axa S.A. (referred to as AXA) is a French multinational insurance company. Its headquarters are located in the 8th arrondissement of Paris, France. It also provides investment management and other financial services.

The Axa Group operates primarily in Western Europe, North America, the India-Pacific region and the Middle East, and also has a presence in Africa. Axa is a conglomerate of independent companies, managed under the laws and regulations of many countries. It is a constituent of the Euro Stoxx 50 stock index.

Humana (U.S.)

.PNG) |

| Humana (U.S.) |

Humana Inc. is an American for-profit health insurance company based in Louisville, Kentucky. In 2021, the company ranked 41st on the Fortune 500 list, making it the highest-ranked company (by revenue) based in Kentucky. It was the third-largest health insurance provider in the nation.

Health insurer Aetna said on July 3, 2015, that it had agreed to acquire smaller rival Humana for $37 billion in cash and stock, but it pulled out of the deal after a court ruled that the merger would be anticompetitive.

Munich RE (Germany)

.PNG) |

| Munich RE (Germany) |

Munich Re Group or Munich Reinsurance Company (German: Münchener Rück; Münchener Rückversicherungs-Gesellschaft) is a German multinational insurance company based in Munich, Germany. It is one of the world's leading reinsurers. ERGO, a subsidiary of Munich Re, is the group's main insurance business. Munich Re's shares are listed on all German stock exchanges and on the Xetra electronic trading system. Munich Re is included in the DAX index of the Frankfurt Stock Exchange, the Euro Stoxx 50, and other indices.

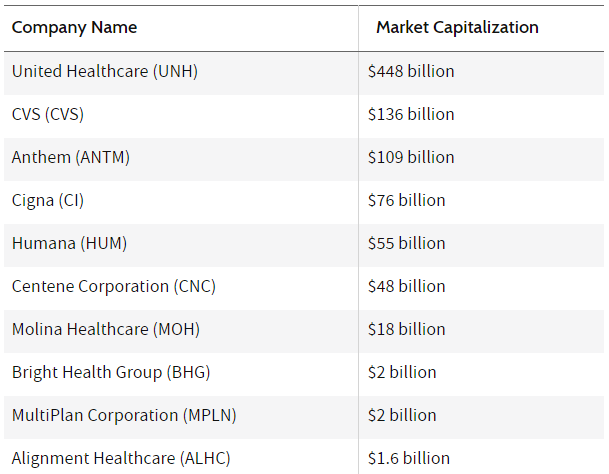

Publicly Traded Health Insurance and Managed Health Care Companies

|

| Publicly Traded Health Insurance and Managed Health Care Companies |

United Healthcare (UNH)

UnitedHealth Group Incorporated is a U.S. multinational health care management and insurance company based in Minnetonka, Minnesota. It provides health care products and insurance services. UnitedHealth Group is the eighth largest company in the world by revenue and the second-largest healthcare company behind CVS Health by revenue, and the largest insurance company by net premiums. UnitedHealthcare's revenues account for 80 percent of the group's overall revenues.

The company is ranked No. 8 on the 2021 Fortune Global 500. UnitedHealth Group has a market capitalization of $400.7 billion as of March 31, 2021.

CVS Health Corporation (CVS)

|

| CVS Health Corporation (CVS) |

CVS Health Corporation (formerly CVS Corporation and CVS Caremark Corporation) is a U.S. healthcare company that owns CVS Pharmacy, a retail pharmacy chain, CVS Caremark, a pharmacy benefit manager, and Aetna, a health insurance provider, among many other brands. The company's headquarters are located in Woonsocket, Rhode Island.

In 2021, CVS Health ranked #4 on the Fortune 500 list and #7 on the Fortune Global 500 list.

Consumer Value Stores (CVS) was founded in 1963 by three partners: brothers Stanley and Sidney Goldstein and Ralph Hoagland, who developed the business from a parent company, Mark Steven, Inc, that helped retailers manage their health and beauty product lines. The company began as a chain of health and beauty stores, but a few years later, pharmacies were added. To facilitate growth and expansion, the company joined the Melville Corporation, which operated a series of retail businesses. After a period of growth in the 1980s and 1990s, CVS Corporation spun off from Melville in 1996, becoming a stand-alone company listed on the New York Stock Exchange as CVS. In December 2017, CVS agreed to acquire Aetna for $69 billion and completed the acquisition in November 2018. Legal issues related to the merger were resolved in September 2019. In February 2020, CVS Health announced changes to its board of directors. Directors Richard "Dick" Swift, Richard Bracken and Mark Bertolini will no longer stand for re-election at the company's 2020 annual meeting and the board will be reduced from 16 to 13 directors.

On November 18, 2021, CVS Health announces that the company plans to close 900 stores over the next three years, with the closure to begin in the spring of 2022.

In November 2021, a federal jury found that CVS, along with Walgreens and Walmart, had "substantially contributed" to the opioid crisis.

Anthem (ANTM)

.PNG) |

| Anthem (ANTM) |

Anthem, Inc. is a health insurance provider in the United States. It is the largest for-profit managed care company in Blue Cross Blue Shield. As of 2018, the company had approximately 40 million members.

Anthem is ranked 23rd on the Fortune 500.

Prior to 2014, it was known as WellPoint, Inc. The company was formed by the 2004 merger of California-based WellPoint and Indianapolis-based Anthem after the two companies acquired several health insurance companies.

The company operates as Anthem Blue Cross in California, where it has about 800,000 customers and is the largest health insurer. It operates as Empire BlueCross BlueShield in New York and as Anthem Blue Cross and Blue Shield in 10 states. As of October 2021, Anthem had 45.1 million medical members.

Cigna (CI)

.PNG) |

| Cigna (CI) |

Cigna is a U.S. multinational health care management and insurance company headquartered in Bloomfield, Connecticut. Its insurance subsidiaries are major providers of medical, dental, disability, life and accident insurance, and related products and services, the majority of which are offered through employers and other groups (e.g., governmental and non-governmental organizations, unions, and associations). Cigna is incorporated in Connecticut.

Cigna provides Medicare and Medicaid products and health, life, and accident insurance coverage primarily to individuals in the United States and certain international markets. In addition to its current operations described above, Cigna also has certain run-off operations, including a run-off reinsurance segment. In the Phoenix metropolitan area, Cigna operates a full-service health maintenance organization with satellite clinics throughout the region, known as Cigna Medical Group. Cigna Global Health Benefits also operates within Cigna.

The company ranked 13th on the 2021 Fortune 500 list, which identifies the largest U.S. companies based on total revenue.

On March 7, 2018, it was announced that Cigna would acquire Express Scripts in a $67 billion transaction, and on August 24, 2018, Cigna and Express Scripts shareholders approved the deal.

Humana (U.S.)

.PNG) |

| Humana (U.S.) |

Humana Inc. is an American for-profit health insurance company based in Louisville, Kentucky. In 2021, the company ranked 41st on the Fortune 500 list, making it the highest-ranked company (by revenue) based in Kentucky. It was the third-largest health insurance provider in the nation.

Health insurer Aetna said on July 3, 2015, that it had agreed to acquire smaller rival Humana for $37 billion in cash and stock, but it pulled out of the deal after a court ruled that the merger would be anticompetitive.

Centene Corporation (CNC)

.PNG) |

| Centene Corporation (CNC) |

Centene Corporation is a publicly-traded managed care company based in St. Louis, Missouri. It serves as a conduit for government-sponsored and privately insured health care programs. Centene is ranked 24th in the 2021 Fortune 500.

In the United Kingdom, Centene began acquiring local healthcare services in 2017. In 2019, Centene, through its subsidiary MH Services, acquired a 40% stake in Circle Health in a deal that created a national network of more than 50 private hospitals. In early 2021, Operose Health, a U.K. subsidiary of Centene, acquired a London-based practice group, AT Medics.

Molina Healthcare (MOH)

.PNG) |

| Molina Healthcare (MOH) |

Molina Healthcare is a managed care company headquartered in Long Beach, California, USA. The company provides health insurance to individuals through government programs such as Medicaid and Medicare.

Molina Healthcare was founded in 1980 by C. David Molina, an emergency room physician in Long Beach, California. He had noticed an influx of patients going to the emergency room for common illnesses such as a sore throat or the flu because they were being turned away by doctors who did not accept Medi-Cal. Molina created its first primary care clinic with the goal of treating the lowest income patients, regardless of their ability to pay.

In September 2020, Molina Healthcare entered into an agreement to purchase approximately all of Affinity Health Plan's assets for approximately $380 million.

Bright Health Group (BHG)

.PNG) |

| Bright Health Group (BHG) |

Bright Health is an American health insurance company based in Minneapolis, Minnesota.

In January 2020, Bright Health appointed former Target executive Cathy Smith as CFO, replacing Don Powers. That same month, the company announced it would acquire Brand New Day Health Plan, increasing its reach into the Medicare Advantage market. The acquisition also allowed Bright Health to begin offering services in California. Bright Health became Minnesota's first "unicorn" when it reached a $1 billion valuation. G. Mike Mikan became the company's CEO in April 2020.

In 2020, the company promoted former Periscope CEO Liz Ross to the new chief marketing officer. Bright Health raised $500 million in Series E funding in September 2020.

In early 2021, Bright Health announced record membership growth, providing coverage to over 500,000 consumers. The company also announced another acquisition in California, Central Health Plan of California Inc, further expanding the Medicare Advantage business.

MultiPlan Corporation (MPLN)

.PNG) |

| MultiPlan Corporation (MPLN) |

MultiPlan Corporation is a provider of end-to-end, data analytics and technology-based cost management, payment, and revenue integrity solutions for the U.S. healthcare industry. The company's services include analytics-based services, which use an information technology platform to provide clients with analytics-based services to detect claims overcharges and recommend or negotiate fair reimbursement. Its network-based services include multiplan primary and complementary networks in which payers can use its national network of contracted providers to process claims at a discounted price. Its payment integrity services use data, technology, and clinical expertise to identify inappropriate, unnecessary, and excessive charges before or after claims are paid. Its revenue integrity services use data, technology, and clinical expertise to improve the accuracy of premiums paid to health benefit plans by the Centers for Medicare and Medicaid Services (CMS).

Alignment Healthcare (ALHC)

.PNG) |

| Alignment Healthcare (ALHC) |

Alignment Healthcare is a consumer-centric platform that provides personalized healthcare in the U.S. to seniors and those who need it most, the chronically ill and frail, through its Medicare Advantage plans. Alignment Healthcare provides partners and patients with personalized care and services where and when they need them, including clinical coordination, risk management, and technology facilitation. Alignment Healthcare offers health plan options through Alignment Health Plan, and also partners with select health plans to help provide better benefits at lower costs.

A mutual company typically offers a captive agent program. A captive agent is one who works for and exclusively represents that particular insurance company for an ongoing commission. Some argue that captive agents are harder working than independent agents because they only represent one insurance company, as opposed to independent agents who may have dozens of carriers from which to select.

With regard to insurance provider oversight, captive agents are more likely to be directly supervised by upper management. Many independent agencies employ supervisors and branch managers to oversee multiple locations; however, these agency owners and other senior-level agents generally do not actually work in the field. For a captive agent, it is usually not unusual for him or her to report directly to a top executive at headquarters or at least have someone there for whom they ultimately report (such as an agency vice president). Additionally, at many captive agencies, it is quite common for lower-level staff members (both customer service employees and sales) to actually wear suits every day as opposed to regular clothes.

Largest Insurance Companies by Revenue and Product Line

It is useful to differentiate the type of insurance, or line, considered when looking at the largest insurance companies. Using sales data is useful because some of the largest insurance companies in the U.S. are not publicly traded, so their market value is not easily determined.

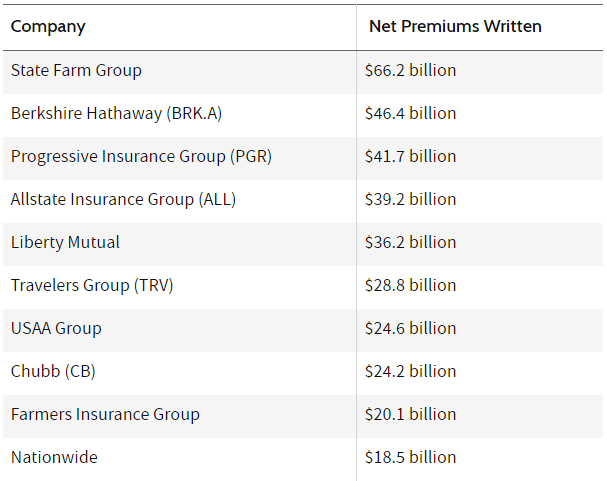

Property and casualty insurance

Property and casualty insurers write policies covering assets such as real estate, homes, cars, and other vehicles. They also write policies dealing with the liabilities that may be incurred by an accident or negligence related to such property to defray the cost of lawsuits or medical damages resulting from such incidents.

The top U.S. property and casualty insurance companies in terms of net premiums written (the amount of money property and casualty policies can expect to receive over the life of the policy, fewer commissions and costs) are:

|

| Largest Insurance Companies by Revenue and Product Line |

State Farm Group

|

| State Farm Group |

State Farm Insurance is a large group of mutual insurance companies throughout the United States, headquartered in Bloomington, Illinois.

State Farm is the largest provider of property and casualty insurance, and the largest provider of auto insurance, in the United States. State Farm is ranked 36th in the 2019 Fortune 500, which lists U.S. companies based on revenue.

State Farm relies on exclusive agents (also called captive agents) to sell insurance. Only State Farm agents can sell State Farm insurance, and their agents can only sell State Farm products.

Berkshire Hathaway (BRK.A)

.PNG) |

| Berkshire Hathaway (BRK.A) |

Berkshire Hathaway Inc is an American multinational conglomerate holding company headquartered in Omaha, Nebraska, USA. The company wholly owns GEICO, Duracell, Dairy Queen, BNSF, Lubrizol, Fruit of the Loom, Helzberg Diamonds, Long & Foster, FlightSafety International, Shaw Industries, Pampered Chef, Forest River, and NetJets, and also owns 38. 6% of Pilot Flying J; and significant minority stakes in public companies Kraft Heinz Company (26.7%), American Express (18.8%), The Coca-Cola Company (9.32%), Bank of America (11.9%), and Apple (6.3%).

Beginning in 2016, the company acquired significant stakes in major U.S. airlines, namely United Airlines, Delta Air Lines, Southwest Airlines, and American Airlines, but sold all of its airline holdings in early 2020 following the COVID-19 pandemic. Berkshire Hathaway has delivered an average of 19.0% annual growth in book value to its shareholders since 1965 (compared to 9.7% for the S&P 500, including dividends, for the same period), while employing large amounts of capital and minimal debt.

The company is known for its control and leadership by Warren Buffett, who serves as chairman and CEO, and Charlie Munger, the company's vice-chairman. Early in his career at Berkshire, Buffett focused on long-term investments in publicly traded companies, but more recently he has more frequently purchased entire companies. Berkshire now owns a diverse range of businesses, including candy stores, retail businesses, railroads, home furnishings, encyclopedias, vacuum cleaner manufacturers, jewelry sales, uniform manufacturing and distribution, and several regional electric and gas utilities.

According to the Forbes Global 2000 list and formula, Berkshire Hathaway is the eighth largest public company in the world, the tenth-largest conglomerate by revenue, and the largest financial services company by revenue in the world.

As of August 2020, Berkshire's Class B stock is the seventh-largest component of the S&P 500 Index (which is based on free-floating market capitalization) and the company is famous for having the most expensive stock price in history, with Class A shares costing about $550,000 each. This is because its Class A shares have never been split and Buffett stated in a letter to shareholders in 1984 that he had no intention of splitting the stock.

On March 16, 2022, Berkshire Hathaway's Class A shares closed above the record high of $500,000 per share, bringing the company's market capitalization to over $730 billion.

Progressive Insurance Group (PGR)

.PNG) |

| Progressive Insurance Group (PGR) |

The Progressive Corporation is an American insurance company, the third-largest insurance company, and the number one commercial auto insurer in the United States. The company was co-founded in 1937 by Jack Green and Joseph M. Lewis and is headquartered in Mayfield Village, Ohio. The company ensures passenger vehicles, motorcycles, RVs, trailers, boats, personal watercraft, and commercial vehicles. Progressive also offers home, life, pet, and other insurance through select companies. Progressive has also expanded internationally, offering auto insurance in Australia.

The company is ranked #74 on the 2021 Fortune 500 list of the largest U.S. companies.

Allstate Insurance Group (ALL)

.PNG) |

| Allstate Insurance Group (ALL) |

The Allstate Corporation is an American insurance company, headquartered in Northfield Township, Illinois, near Northbrook since 1967. Founded in 1931, it was part of Sears, Roebuck, and Co. and spun off in 1993. The company also has personal line operations in Canada.

Allstate is a large company, and with 2018 sales of $39.8 billion, it is ranked 79th on the 2019 Fortune 500 list of largest U.S. companies by total revenue. Its current ad campaign, used since 2004, asks the question "Are you in good hands?", building on its well-established previous ads showing a suburban-style home, cradled protectively by a pair of presumably giant human hands.

Liberty Mutual Insurance

|

| Liberty Mutual Insurance |

Liberty Mutual Group is a globally diversified U.S. insurer and the sixth-largest property and casualty insurer in the United States. It is ranked 71st on the Fortune 100 list of the largest companies in the United States, based on 2020 revenues. Headquartered in Boston, Massachusetts, and featuring the Statue of Liberty (formerly Liberty Enlightening the World) on its logo, it employs more than 45,000 people in over 900 locations worldwide. As of December 31, 2021, Liberty Mutual Insurance had $156.043 billion in consolidated assets, $128.195 billion in consolidated liabilities, and $48.2 billion in consolidated annual revenues.

The company, founded in 1912, offers a wide range of insurance products and services, including personal auto insurance, homeowners insurance, workers' compensation insurance, commercial property and casualty insurance, commercial auto insurance, general liability insurance, global specialty insurance, group disability insurance, fire insurance, and surety insurance.

Liberty Mutual Group owns, in whole or in part, local insurance companies in Argentina, Brazil, Chile, China (including Hong Kong), Colombia, Ecuador, India, Ireland, Malaysia, Poland, Portugal, Singapore, Spain, Thailand, Turkey, the United Kingdom, Venezuela, and Vietnam.

In the United States, Liberty Mutual remains a mutual company in which policyholders are considered shareholders of the company. However, the Liberty Mutual Group brand generally operates as a separate entity outside the United States, where a subsidiary is often established in countries where the benefits of a legally recognized mutual company are not available.

The current CEO is David H. Long. Long, succeeded his predecessor Edmund (Ted) F. Kelly on June 29, 2011. Mr. Kelly was appointed CEO in 1998 and retired from the board as chairman in April 2013.

Travelers Group (TRV)

.PNG) |

| Travelers Group (TRV) |

USAA Group

|

| USAA Group |

United Services Automobile Association (USAA) is a Fortune 500 diversified financial services group based in San Antonio that includes a Texas Department of Insurance-regulated reciprocal inter-insurance exchange and subsidiaries offering banking, investment, and insurance services to individuals and families who serve or have served, in the U.S. armed forces. At the end of 2020, it had more than 13 million members.

USAA was founded in 1922 in San Antonio by a group of 25 U.S. Army officers as a mutual self-insurance mechanism when they could not obtain auto insurance due to the perception that they, as military officers, were a high-risk group. USAA has since grown to provide banking and insurance services to past and present members of the armed forces, officers and enlisted, and their families. The company ranked 100th on the 2018 Fortune 500 list, which identifies the largest U.S. companies based on total revenue.

Chubb (CB)

Chubb Limited, a U.S. corporation incorporated in Zurich, Switzerland, is the parent company of Chubb, a global provider of insurance products covering property and casualty, accident and health, reinsurance and life insurance, and the world's largest property and casualty insurance company. Chubb is the world's largest publicly traded property and casualty insurance company. Chubb operates in 55 countries and territories and in Lloyd's insurance market in London. Chubb's customers include multinational and local companies, individuals, and insurers seeking reinsurance coverage. Chubb offers commercial and personal property and casualty insurance, personal accident and supplementary health insurance, reinsurance, and life insurance.

As of 2018, the group had $174 billion in assets, $30.8 billion in gross written premium, and approximately 31,000 employees. Chubb is listed on the New York Stock Exchange and is part of the S&P 500 Index. Its major insurance companies are rated "AA" (very strong) for financial strength by Standard & Poor's and "A++" (superior) by A. M. M.. (superior) by A. M. Best with stable outlooks for both agencies. Fitch rates Chubb Limited and its subsidiaries "AA" (very strong) for financial strength, "AA-" for issuer default, and "A+" for senior debt. Moody's rates the U.S. companies "A1" and the unsecured loan bills "A3".

On July 1, 2015, ACE announced that it would acquire the former Chubb Corporation for $28.3 billion in cash and stock. ACE committed that Chubb's current headquarters in Warren, New Jersey, U.S.A., would have a substantial portion of the headquarters function for the North American division of the combined company. The combined company adopted the Chubb name in January 2016 after the acquisition was completed.

Farmers Insurance Group (informally Farmers) is a U.S.-based group of auto, home, and small business insurers and also provides other insurance and financial services products. Farmers Insurance has more than 48,000 exclusive and independent agents and approximately 21,000 employees. Farmers is the trade name for three reciprocal insurers, Farmers, Fire, and Truck, owned by their policyholders. The non-claims business of Farmers is managed by a de facto agent, Farmers Group Inc, which is a wholly-owned subsidiary of Zurich Insurance Group.

Nationwide Mutual Insurance Company and its affiliates, commonly abbreviated as Nationwide, is a group of large U.S. insurance and financial services companies headquartered in Columbus, OH. The company also has regional headquarters in Scottsdale, AZ; Des Moines, IA; San Antonio, TX; Gainesville, FL; Raleigh, NC; Sacramento, CA, and Westerville, OH. Nationwide currently has approximately 25,391 employees and is ranked #76 on the 2019 Fortune 500 list. Nationwide is currently ranked #25 on Fortune's "100 Best Companies to Work For" list.

Nationwide Financial Services (NFS), a component of the group, was partially listed on the New York Stock Exchange before being acquired by Nationwide Mutual in 2009. Nationwide Mutual had owned the majority of NFS common stock since its IPO in 1997.

Life Insurance Companies

Life insurance companies promise to pay a lump sum upon the death of the insured. Although actuarial science has created mortality tables to accurately estimate future policy liabilities to be paid, having financial strength ensures that these companies can meet all their obligations and still make a profit.

Life insurance companies in the U.S. can be ranked based on direct written premiums (the number of new policies issued directly and not reinsured).

Global direct written premiums for life insurance stood at $820 billion, according to Swiss Re. Direct premiums in life insurance (the most common form of insurance) totaled $2.09 trillion last year; that same year, there were 487 individual companies writing business worldwide. This list recognizes what we consider to be 10 of those very large and successful firms.

|

| Life Insurance Companies |

New York Life Grp

|

| New York Life Grp |

New York Life Insurance Company (NYLIC) is the third-largest life insurance company in the United States, the largest mutual life insurance company in the United States, and ranks 67th on the 2021 Fortune 500 list of the largest companies in the United States based on total revenue. NYLIC has approximately $593 billion in total assets under management and more than $25 billion in surplus and AVR. In 2007, NYLIC received the highest possible ratings from all four independent rating companies (Standard & Poor's, AM Best, Moody's, and Fitch). Other New York Life affiliates provide a range of securities-related products and services, as well as institutional and retail mutual funds.

Northwestern Mutual

|

| Northwestern Mutual |

Northwestern Mutual is an American financial services mutual based in Milwaukee. The financial security company offers consultations on wealth and asset income protection, education planning, retirement planning, investment advisory services, trust, and private client services, estate planning, and business planning. Its products include life insurance, permanent life insurance, disability, and long-term care insurance, annuities, investments, and investment advisory products and services. Northwestern Mutual ranked 90th on the 2021 Fortune 500 list of largest U.S. companies by total revenue and is in the top 30 by assets owned. The firm distributes a portion of its earnings to eligible policyholders in the form of annual dividends.

Metropolitan Group (MET)

.PNG) |

| Metropolitan Group (MET) |

The Metropolitan Life Insurance Company Tower (known as the Met Life Tower or South Building) is a skyscraper that occupies an entire city block in the Flatiron District of Manhattan, New York. The building is composed of two sections: a 210-meter-high tower at the northwest corner of the block, at Madison Avenue and 24th Street, and a shorter east wing occupying the rest of the block bounded by Madison Avenue, Park Avenue South, 23rd Street, and 24th Street. The South Building, along with the North Building just across 24th Street, form the Metropolitan Home Office Complex, which originally served as the headquarters of the Metropolitan Life Insurance Company (now known as MetLife).

The South Building tower was designed by the architectural firm Napoleon LeBrun & Sons and erected between 1905 and 1909. Inspired by the Campanile of St. Mark's, the tower features four clock faces, four bells, and light beacons at its top, and was the tallest building in the world until 1913. The tower originally included the offices of Metropolitan Life, and since 2015 has housed a 273-room luxury hotel known as the New York Edition Hotel. The tower was designated a city landmark by the New York City Landmarks Preservation Commission in 1989 and was listed on the National Register of Historic Places in 1972. It was also designated a National Historic Landmark in 1978.

The East Wing was designed by Lloyd Morgan and Eugene Meroni and built in two stages between 1953 and 1960. The East Wing is also known as One Madison Avenue. It replaced another building on the site, which was built in phases from 1893 to 1905, and was also designed by the LeBrun firm. When the current east wing was built, the 700-foot tower was also extensively renovated. In 2020, work began on an addition to the east wing, which will be designed by Kohn Pedersen Fox and completed in 2023 or 2024.

Prudential of America (PRU)

.PNG) |

| Prudential of America (PRU) |

Prudential Financial, Inc. is a U.S. Fortune Global 500 company whose subsidiaries provide insurance, investment management, and other financial products and services to individual and institutional clients in the United States and more than 40 other countries.

Prudential Financial is the largest insurance company in the United States, with total assets of approximately US$1.456 trillion.

The principal products and services provided include life insurance, annuities, mutual funds, pension and retirement investments, asset administration and management, and securities brokerage services. It provides these products and services to individual and institutional customers through distribution networks in the financial services industry. Prudential has operations in the United States, Asia, Europe, and Latin America and has organized its principal businesses into financial services and closed-end block businesses.

Prudential is made up of hundreds of subsidiaries and holds over $4 trillion in life insurance.

The company uses the Rock of Gibraltar as its logo.

Lincoln National

|

| Lincoln National |

Lincoln National Corporation is a Fortune 250 U.S. holding company that operates several insurance and investment management businesses through subsidiaries. Lincoln Financial Group is the trade name for LNC and its subsidiaries.

LNC was incorporated under the laws of the State of Indiana in 1968, and its principal executive offices are located in Radnor, Pennsylvania. The company has its roots in its oldest predecessor, founded in 1905.

In addition, LNC is the naming rights sponsor of Lincoln Financial Field in Philadelphia, the home field of the National Football League's Philadelphia Eagles.

MassMutual

|

| MassMutual |

Massachusetts Mutual Life Insurance Company, also known as MassMutual, is a life insurance company based in Springfield, Massachusetts.

MassMutual offers financial products such as life insurance, disability insurance, long-term care insurance, retirement plan/401(k) services, and annuities. Its principal subsidiaries are Barings LLC and Haven Life Insurance Agency.

MassMutual ranked 93rd on the 2018 Fortune 500 list of the largest U.S. companies based on total revenue. The company has revenues of $29.6 billion and assets under management of $675 billion (as of 2016). The company employs more than 7,000 people in the U.S., and a total of 10,614 people internationally.

State Farm Group

|

| State Farm Group |

State Farm Insurance is a large group of mutual insurance companies throughout the United States, headquartered in Bloomington, Illinois.

State Farm is the largest provider of property and casualty insurance, and the largest provider of auto insurance, in the United States. State Farm is ranked 36th in the 2019 Fortune 500, which lists U.S. companies based on revenue.

State Farm relies on exclusive agents (also called captive agents) to sell insurance. Only State Farm agents can sell State Farm insurance, and their agents can only sell State Farm products.

Aegon (AEG)

.PNG) |

| Aegon (AEG) |

Aegon N.V. is Dutch multinational life insurance, pension, and asset management company headquartered in The Hague, the Netherlands. As of July 21, 2020, the company had 26,000 employees. Aegon is listed on Euronext Amsterdam and is part of the AEX index.

Aegon's activities focus on life insurance and pension products, savings, and asset management. The group is also active in an accident and supplementary health insurance and general insurance and has limited banking activities. Aegon has significant operations in the United States (where it is strongly represented by World Financial Group and Transamerica), the Netherlands, and the United Kingdom. In addition, the group has operations in a number of other countries, including Canada, Brazil, Mexico, Hungary, Poland, Romania, Slovakia, Czech Republic, Turkey, Spain, China, Japan, North America, and India.

Aegon's global headquarters are located in The Hague, Netherlands.

John Hancock

|

| John Hancock |

John Hancock Life Insurance Company, U.S.A. is a Boston-based insurance company. Founded on April 21, 1862, it was named after John Hancock, a prominent patriot.

In 2004, John Hancock was acquired by the Canadian life insurance company Manulife Financial. The company and the majority of Manulife's U.S. assets continue to operate under the John Hancock name.

John Hancock created an index called the John Hancock Investor Sentiment Index in 2011. The company describes the index as a "quarterly measure of investor sentiment on a range of investment choices, life goals, and economic outlooks."

Minnesota Mutual Grp

|

| Minnesota Mutual Grp |

Securian Financial Group, Inc. is a mutual holding company that provides a range of financial products and services. Founded in St. Paul, Minnesota, by Russell Dorr on August 6, 1880, Securian Financial provides insurance, retirement investment products, and trust services to more than 19 million customers in the United States, Puerto Rico, and Canada.

In 2018, the company managed $78.6 billion in assets and had nearly $1.2 trillion in insurance in force.

Minnesota Mutual Companies, Inc. is the parent holding company headquartered in St. Paul, MN, with a mutual ownership model that operates under the name "Securian Financial." It is the parent company of Securian Financial Group, Inc. (which is technically a stock subsidiary, but not publicly held or traded), as well as several other companies that provide a wide range of financial services, including:

- Minnesota Life Insurance Company

- Securian Life Insurance Company

- Securian Financial Services

- Securian Trust Company

- Allied Solutions

- Securian Asset Management

- Asset Allocation and Management Company (AAM)

- Securian Casualty Company

- American Modern Life Insurance Company

- Southern Pioneer Life Insurance Company

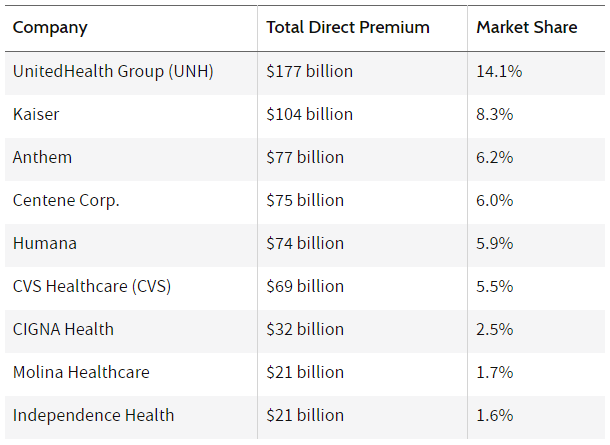

Health insurance companies

Health insurance companies offer policies that cover all or part of the insured's health and medical expenses. Policies can be purchased individually or through an employer. Technically, the U.S. government is the largest provider of health insurance in America through the Medicare program, Social Security, and Medicaid administered by the individual states.

According to the National Association of Insurance Commissioners (NAIC) report, the largest non-government-sponsored U.S. health insurance companies, measured by total direct premiums collected, are:

|

| Health insurance companies |

UnitedHealth Group (UNH)

.PNG) |

| UnitedHealth Group (UNH) |

UnitedHealth Group Incorporated is a U.S. multinational health care management and insurance company based in Minnetonka, Minnesota. It provides health care products and insurance services. UnitedHealth Group is the eighth largest company in the world by revenue and the second-largest healthcare company behind CVS Health by revenue, and the largest insurance company by net premiums. UnitedHealthcare's revenues account for 80 percent of the group's overall revenues.

The company is ranked No. 8 on the 2021 Fortune Global 500. UnitedHealth Group has a market capitalization of $400.7 billion as of March 31, 2021.

Kaiser Permanente, commonly known as Kaiser, is an American managed care consortium based in Oakland, California, USA, founded in 1945 by industrialist Henry J. Kaiser and physician Sidney Garfield. Kaiser Permanente is comprised of three distinct but interrelated groups of entities: the Kaiser Foundation Health Plan, Inc. (KFHP) and its regional operating subsidiaries; the Kaiser Foundation Hospitals; and the Permanente regional medical groups. As of 2017, Kaiser Permanente operates in eight states (Hawaii, Washington, Oregon, California, Colorado, Maryland, Virginia, Georgia) and the District of Columbia, and is the largest managed care organization in the United States.

Kaiser Permanente is one of the largest nonprofit health care plans in the United States, with more than 12 million members. It operates 39 hospitals and more than 700 medical practices, with more than 300,000 employees, including more than 80,000 physicians and nurses.

Each Permanente medical group operates as a separate for-profit partnership or professional corporation in its individual territory, and while none publishes its financial results, each is primarily funded by reimbursements from its respective regional entity, Kaiser Foundation Health Plan. KFHP is one of the largest nonprofit organizations in the United States.

KP's quality of care has been highly rated and attributed to its emphasis on preventive care, the fact that its physicians are salaried rather than fee-for-service, and its attempt to minimize the time patients spend in high-cost hospitals by carefully planning their stay. However, Kaiser has had disputes with its employee unions, has been the subject of repeated civil and criminal charges for falsifying records and dumping patients, has been the subject of regulatory actions regarding the quality of care provided, particularly to patients with mental health issues, and has been the subject of activist criticism and regulatory actions regarding the number of its cash reserves.

Anthem

|

| Anthem |

Anthem, Inc. is a health insurance provider in the United States. It is the largest for-profit managed care company in Blue Cross Blue Shield. As of 2018, the company had approximately 40 million members.

Anthem is ranked 23rd on the Fortune 500.

Prior to 2014, it was known as WellPoint, Inc. The company was formed by the 2004 merger of California-based WellPoint and Indianapolis-based Anthem after the two companies acquired several health insurance companies.

The company operates as Anthem Blue Cross in California, where it has about 800,000 customers and is the largest health insurer. It operates as Empire BlueCross BlueShield in New York and as Anthem Blue Cross and Blue Shield in 10 states. As of October 2021, Anthem had 45.1 million medical members.

Centene Corporation (CNC)

.PNG) |

| Centene Corporation (CNC) |

Centene Corporation is a publicly-traded managed care company based in St. Louis, Missouri. It serves as a conduit for government-sponsored and privately insured health care programs. Centene is ranked 24th in the 2021 Fortune 500.

In the United Kingdom, Centene began acquiring local healthcare services in 2017. In 2019, Centene, through its subsidiary MH Services, acquired a 40% stake in Circle Health in a deal that created a national network of more than 50 private hospitals. In early 2021, Operose Health, a U.K. subsidiary of Centene, acquired a London-based practice group, AT Medics.

Humana (U.S.)

.PNG) |

| Humana (U.S.) |

Humana Inc. is an American for-profit health insurance company based in Louisville, Kentucky. In 2021, the company ranked 41st on the Fortune 500 list, making it the highest-ranked company (by revenue) based in Kentucky. It was the third-largest health insurance provider in the nation.

Health insurer Aetna said on July 3, 2015, that it had agreed to acquire smaller rival Humana for $37 billion in cash and stock, but it pulled out of the deal after a court ruled that the merger would be anticompetitive.

CVS Health Corporation (CVS)

|

| CVS Health Corporation (CVS) |

CVS Health Corporation (formerly CVS Corporation and CVS Caremark Corporation) is a U.S. healthcare company that owns CVS Pharmacy, a retail pharmacy chain, CVS Caremark, a pharmacy benefit manager, and Aetna, a health insurance provider, among many other brands. The company's headquarters are located in Woonsocket, Rhode Island.

In 2021, CVS Health ranked #4 on the Fortune 500 list and #7 on the Fortune Global 500 list.

Consumer Value Stores (CVS) was founded in 1963 by three partners: brothers Stanley and Sidney Goldstein and Ralph Hoagland, who developed the business from a parent company, Mark Steven, Inc, that helped retailers manage their health and beauty product lines. The company began as a chain of health and beauty stores, but a few years later, pharmacies were added. To facilitate growth and expansion, the company joined the Melville Corporation, which operated a series of retail businesses. After a period of growth in the 1980s and 1990s, CVS Corporation spun off from Melville in 1996, becoming a stand-alone company listed on the New York Stock Exchange as CVS. In December 2017, CVS agreed to acquire Aetna for $69 billion and completed the acquisition in November 2018. Legal issues related to the merger were resolved in September 2019. In February 2020, CVS Health announced changes to its board of directors. Directors Richard "Dick" Swift, Richard Bracken, and Mark Bertolini will no longer stand for re-election at the company's 2020 annual meeting and the board will be reduced from 16 to 13 directors.

On November 18, 2021, CVS Health announces that the company plans to close 900 stores over the next three years, with the closure to begin in the spring of 2022.

In November 2021, a federal jury found that CVS, along with Walgreens and Walmart, had "substantially contributed" to the opioid crisis.

Cigna (US)

.PNG) |

| Cigna (US) |

Cigna is a U.S. multinational health care management and insurance company headquartered in Bloomfield, Connecticut. Its insurance subsidiaries are major providers of medical, dental, disability, life and accident insurance, and related products and services, the majority of which are offered through employers and other groups (e.g., governmental and non-governmental organizations, unions, and associations). Cigna is incorporated in Connecticut.

Cigna provides Medicare and Medicaid products and health, life, and accident insurance coverage primarily to individuals in the United States and certain international markets. In addition to its current operations described above, Cigna also has certain run-off operations, including a run-off reinsurance segment. In the Phoenix metropolitan area, Cigna operates a full-service health maintenance organization with satellite clinics throughout the region, known as Cigna Medical Group. Cigna Global Health Benefits also operates within Cigna.

The company ranked 13th on the 2021 Fortune 500 list, which identifies the largest U.S. companies based on total revenue.

On March 7, 2018, it was announced that Cigna would acquire Express Scripts in a $67 billion transaction, and on August 24, 2018, Cigna and Express Scripts shareholders approved the deal.

Molina Healthcare (MOH)

.PNG) |

| Molina Healthcare (MOH) |

Molina Healthcare is a managed care company headquartered in Long Beach, California, USA. The company provides health insurance to individuals through government programs such as Medicaid and Medicare.

Molina Healthcare was founded in 1980 by C. David Molina, an emergency room physician in Long Beach, California. He had noticed an influx of patients going to the emergency room for common illnesses such as a sore throat or the flu because they were being turned away by doctors who did not accept Medi-Cal. Molina created its first primary care clinic with the goal of treating the lowest-income patients, regardless of their ability to pay.

In September 2020, Molina Healthcare entered into an agreement to purchase approximately all of Affinity Health Plan's assets for approximately $380 million.

Independence Health

|

| Independence Health |

Independence Blue Cross (Independence) is a health insurer based in Philadelphia, Pennsylvania, USA. Independence is the largest health insurer in the Philadelphia area, serving more than two million people in the region and seven million nationwide.

Employing more than 10,000 people, the company offers a wide variety of health plans, including managed care, and traditional indemnity insurance. Its network of healthcare providers includes nearly 160 area hospitals and more than 42,000 physicians and other healthcare professionals.

Independence is an independent licensee of the Blue Cross and Blue Shield Association.

How much do the CEOs of the largest health insurance companies make?

The following CEOs of the 6 largest health insurance companies earn more than $15 million per year:

- Michael Neidorff of Centene makes $26.4 million.

- David Cordani of Cigna earns $19.1 million.

- David Wichmann of UnitedHealth Group earns $18.9 million.

- Joseph Zubretsky of Molina Healthcare wins $18 million.

- Bruce Broussard of Human wins $16.7 million.

- Gail Boudreaux of Anthem wins $15.5 million.

Are large insurance companies good investments?

Investing in insurance companies can be a safe option for some investors. Insurance companies are built to handle risk, which can ultimately reduce the risks associated with investing in them. Health insurance, subject to rapid change, has significant growth potential compared to other types of insurance companies.

While insurance companies are a solid investment option, you still need to do your research. Look at a variety of different factors including any fluctuations in premium costs and whether or not they're growing or declining over time. The best way to figure out how an insurance company is doing is by looking at its balance sheet, particularly when comparing it with previous years' balance sheets. Another way to evaluate an insurance company's financial stability is by analyzing its operating cash flow metrics. One of these metrics involves return on capital, which shows what percentage of capital was used during a given period of time while generating income for shareholders. Finally, you can examine how much debt the insurance company has versus its equity.

Who are the biggest investors in insurance companies?

The largest investors in insurance companies are generally other institutions. For example, UnitedHealth Group (UNH) has 4,124 institutional owners, who own more than 1 billion shares.

Other big owners include BlackRock (BLK), Bank of America (BAC), and State Street Corp. (STT). You can also see that some of these companies have insider ownership of more than 10%, such as JPMorgan Chase & Co (JPM), State Street Corp. (STT), and Suntrust Banks Incorporated (STI). These three even have insiders who own over 20% of their company. Finally, you’ll notice a couple of these companies have funds with more than 1% ownership, including Capital Group Companies Inc.

Who are the largest home insurance companies in the United States?

The five largest home insurance companies in the U.S. are State Farm, Allstate, USAA, Liberty Mutual, and Farmers.6 Together, these companies have more than 45 percent of the home insurance market share.

Who are the largest insurance companies in Canada?

The five largest insurance companies in Canada are Manulife Financial Corporation, Great-West Lifeco, Desjardins, Sun Life Financial and Fairfax Financial.7 Manulife is the largest insurance company in Canada, employing more than 35,000 people and serving over 30 million customers.

The bottom line

Ranking the largest insurance companies can be done in several ways. You can buy shares of publicly traded companies to build a well-diversified investment portfolio with exposure to the financial and health care sectors. Identifying the types of insurance that a company primarily deals with helps determine which companies are competitors and which are not. Looking at sales figures, or premiums collected in a year can also show how public companies stack up against the private or mutual companies that make up a large segment of the industry.

Investopedia does not provide investment or financial advice. The information is presented without regard to the investment objectives, risk tolerance, or financial situation of any specific investor and may not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk, including the possible loss of capital.

.PNG)

.PNG)

Comments

Post a Comment